Choosing the Best Broker

Choose your broker

Understanding the Importance of Choosing the Right Broker

Selecting an appropriate broker is a crucial step for anyone venturing into the financial markets. The right broker can significantly impact your trading experience, potential profits, and overall success. A reliable broker provides access to various financial instruments, educational resources, and robust trading platforms. They also ensure the safety of your funds and offer competitive fees. It’s essential to conduct thorough research and consider multiple factors before making a decision. This guide will walk you through the key aspects to consider when choosing a broker, helping you make an informed decision that aligns with your trading goals and preferences.

Evaluating Regulatory Compliance and Security Measures

When selecting a broker, prioritize those regulated by reputable financial authorities. Regulatory compliance indicates that the broker adheres to strict standards and practices, providing a layer of protection for traders. Look for brokers overseen by well-known regulatory bodies such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), or the Australian Securities and Investments Commission (ASIC). These regulators ensure that brokers maintain adequate capital, segregate client funds, and follow fair trading practices. Additionally, assess the broker’s security measures, including encryption protocols for data protection and two-factor authentication for account access.

Key Regulatory Bodies to Look For

- Financial Conduct Authority (FCA) – United Kingdom

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus

- Australian Securities and Investments Commission (ASIC) – Australia

- Securities and Exchange Commission (SEC) – United States

- Financial Services Agency (FSA) – Japan

Assessing the Range of Financial Instruments and Markets

A diverse selection of financial instruments and markets is crucial for traders seeking varied opportunities. Evaluate the broker’s offerings to ensure they align with your trading interests and strategy. Some brokers specialize in specific markets, while others provide a wide range of options. Consider the following aspects:

- Forex pairs available (major, minor, and exotic)

- Stocks and indices from different global markets

- Commodities (precious metals, energy, agricultural products)

- Cryptocurrencies and their trading pairs

- Bonds and other fixed-income securities

- Options and futures contracts

Choose a broker that offers the instruments you’re interested in trading and provides access to the markets you want to explore. This diversity allows for portfolio diversification and the ability to adapt your trading strategy as market conditions change.

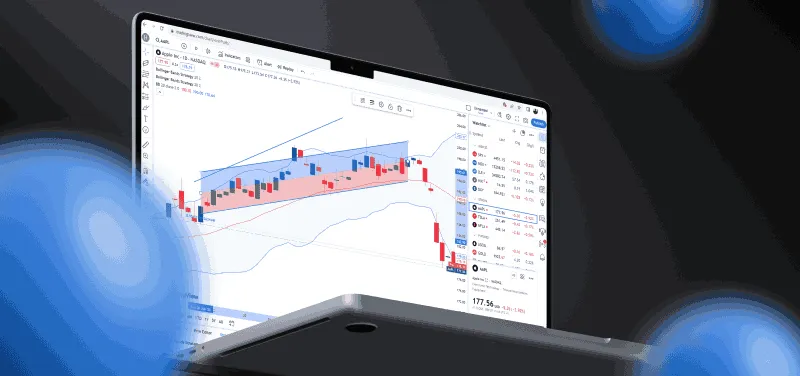

Analyzing Trading Platforms and Technology

The trading platform is your primary interface for executing trades and analyzing markets. It’s crucial to choose a broker offering a user-friendly, stable, and feature-rich platform. Many brokers provide proprietary platforms or support popular third-party software like MetaTrader 4 or 5. Consider the following factors when evaluating trading platforms:

Feature | Description | Importance |

User Interface | Intuitive design and easy navigation | High |

Charting Tools | Advanced technical analysis capabilities | High |

Order Types | Variety of order execution options | Medium |

Mobile Trading | Robust mobile app for on-the-go trading | High |

Customization | Ability to personalize workspace and indicators | Medium |

Automated Trading | Support for algorithmic and copy trading | Medium |

Test the platform through a demo account to ensure it meets your needs and preferences. Pay attention to the speed of order execution, platform stability during high-volatility periods, and the availability of necessary analytical tools.

Examining Fees, Spreads, and Commission Structures

Trading costs can significantly impact your profitability, especially for frequent traders. Compare the fee structures of different brokers, considering factors such as spreads, commissions, and overnight financing charges. Some brokers offer fixed spreads, while others provide variable spreads that fluctuate based on market conditions. Commission-based accounts might be more suitable for high-volume traders, while spread-based accounts could benefit occasional traders. Consider the following cost factors:

- Spread on major currency pairs and popular instruments

- Commission per trade (if applicable)

- Overnight swap rates for holding positions

- Inactivity fees or account maintenance charges

- Deposit and withdrawal fees

- Additional costs for premium features or market data

Create a comprehensive comparison of these costs across multiple brokers to determine which offers the most competitive pricing structure for your trading style and volume.

Evaluating Customer Support and Educational Resources

Reliable customer support is essential, especially when dealing with technical issues or account-related queries. Assess the broker’s support channels, response times, and the quality of assistance provided. Look for brokers offering multiple communication methods, such as live chat, email, phone support, and a comprehensive FAQ section. Additionally, consider the educational resources provided by the broker, which can be valuable for both novice and experienced traders. These resources may include:

Considering Account Types and Minimum Deposit Requirements

Brokers often offer various account types catering to different trader profiles, from beginners to professional traders. Evaluate the account options available and choose one that aligns with your trading capital and experience level. Consider the following factors:

Account Type | Typical Features | Suitable For |

Standard | Basic features, wider spreads | Beginners |

Premium | Tighter spreads, additional tools | Intermediate traders |

Professional | Low spreads, high leverage, advanced tools | Experienced traders |

Pay attention to the minimum deposit requirements for each account type. Some brokers offer micro accounts with low minimum deposits, which can be suitable for beginners or those with limited capital. Ensure that the account type you choose provides the necessary features and trading conditions to support your strategy.

Assessing Deposit and Withdrawal Options

The ease and speed of funding your account and withdrawing profits are important considerations. Look for brokers offering a variety of deposit and withdrawal methods, including:

- Bank wire transfers

- Credit/debit cards

- E-wallets (e.g., PayPal, Skrill, Neteller)

- Cryptocurrencies (if supported)

- Local payment methods specific to your country

Consider the processing times and any associated fees for each method. Some brokers may offer faster withdrawal times or lower fees for certain payment options. Ensure that the broker supports payment methods that are convenient and accessible for you.

Evaluating Additional Features and Services

Beyond the core trading functionalities, many brokers offer additional features and services that can enhance your trading experience. These may include:

Value-Added Services to Consider

- Social trading and copy trading capabilities

- Virtual Private Server (VPS) hosting for automated trading

- Advanced market analysis and research tools

- API access for custom integrations

- Negative balance protection

- Price alerts and notifications

While these features may not be essential for all traders, they can provide added value and potentially improve your trading outcomes. Consider which of these services align with your trading goals and strategy.

Making the Final Decision

After carefully evaluating all the factors mentioned above, create a shortlist of brokers that meet your criteria. Consider opening demo accounts with each of these brokers to test their platforms, analyze their trading conditions, and experience their customer support firsthand. Pay attention to the overall user experience and how comfortable you feel using each broker’s services. Remember that the best broker for you may not be the same for another trader, as individual needs and preferences vary. Take your time to make an informed decision, as choosing the right broker is a crucial step in your trading journey.

FAQ Section

Regulation is crucial as it ensures that the broker adheres to strict financial standards, protects client funds, and follows fair trading practices. Always prioritize brokers regulated by reputable authorities to safeguard your investments.

While competitive fees are important, they shouldn’t be the only factor in your decision. Consider the overall package, including platform quality, customer support, educational resources, and the range of available instruments.

The choice between proprietary and third-party platforms depends on your preferences and trading needs. Proprietary platforms may offer unique features, while popular third-party software like MetaTrader provides familiarity and a wide range of custom indicators. Test both options through demo accounts to determine which suits you best.

Read also

AvaTrade Review

AvaTrade is a well-established online trading platform that caters to traders worldwide, including South Africa. As a regulated broker, AvaTrade South Africa offers a diverse

AvaTrade Review: Minimum deposit

At AvaTrade, we understand that every trader’s journey begins with a first step. To accommodate traders of all levels and preferences, we offer flexible minimum

eToro Review: Copy Trading

Copy Trading Introduction eToro pioneered social trading technology. Our platform connects global traders. South African investors copy experienced traders. Automatic copying requires minimal experience. Success

eToro Review: Login

Account Access Fundamentals eToro maintains secure access protocols. Multiple authentication layers protect accounts. South African traders receive standardized access. Platform security meets international standards. Account

AvaTrade Review: Login

At AvaTrade, we prioritize the security and privacy of our clients’ accounts. Logging into your AvaTrade trading account is a straightforward process designed to ensure

Windsor Brokers Review: $30 Bonus

Windsor Brokers offers a $30 no deposit bonus to new clients opening a Prime Account. This promotion allows traders to experience real market conditions without